Are you a Mortgage Broker?

Can you Handle 10-15 more Appointments per Month?

Let us help you and show you HOW!

With RELoanlink, you'll be using the most leading-edge mortgage tech, the most advanced systems with an automated borrower and agent follow-up tools, and AI powered lead generation. We offer a full suite of productivity tools and much more – all for one low monthly price.

Give us a chance

to show you how we can help!

Get a FREE 30min CONSULTATION!

Are you a Mortgage Broker?

Can you Handle 10-15 more Appointments per Month?

Do you want to fill your pipeline?

With RELoanlink, you'll be using the most leading-edge mortgage tech, the most advanced systems with automated borrower and agent follow-up tools, and AI powered lead generation. We offer a full suite of productivity tools and much more – all for one low monthly price.

No More Cold Calling

Get more opportunities for loans now.

We set up your system and implement the software as a turnkey service. All you need to do is follow up with your customers and get them started!

Enjoy the benefits of a fully-automated mortgage operation

RELoanLink helps loan originators automate frustrating and redundant tasks so they can save time, increase satisfaction, and provide a modern, mobile-optimized mortgage experience for their borrowers.

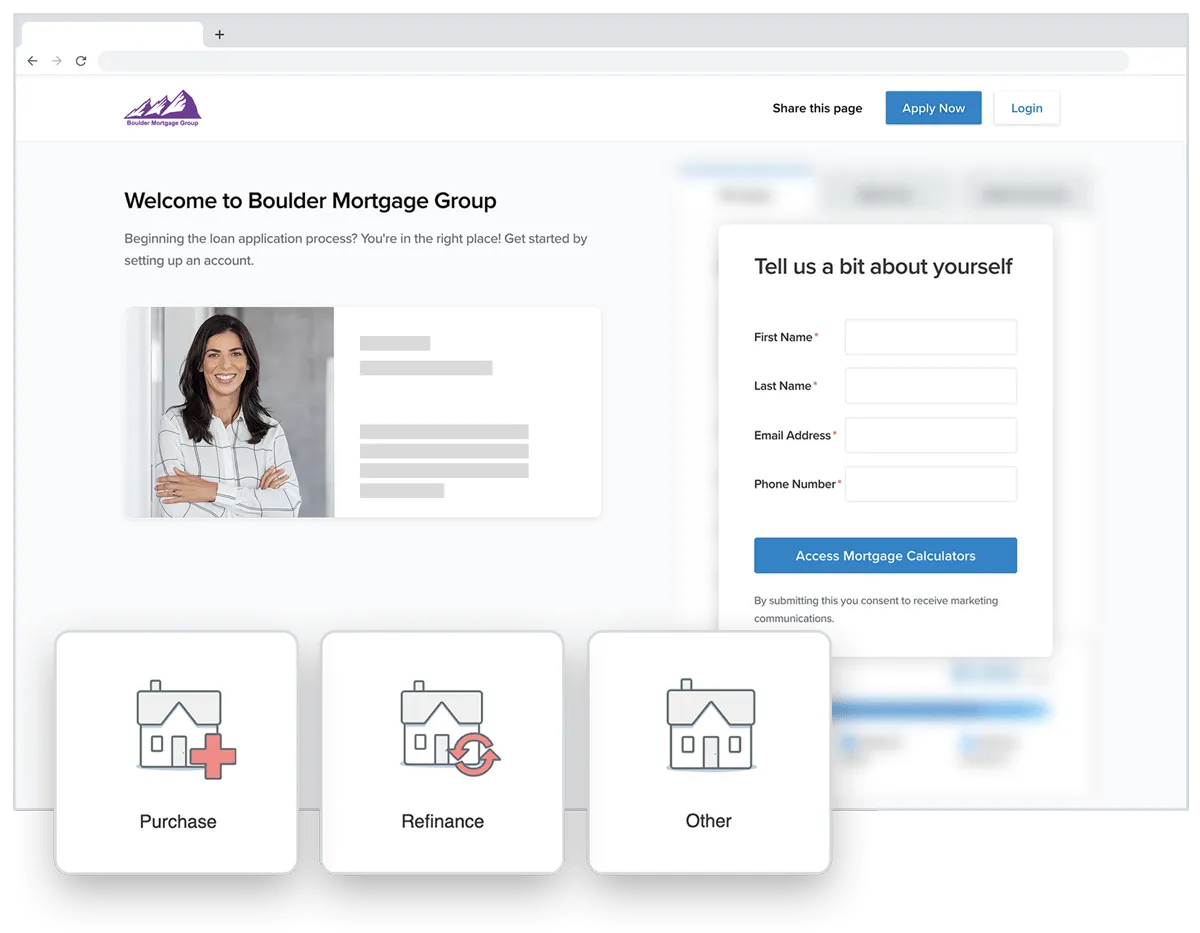

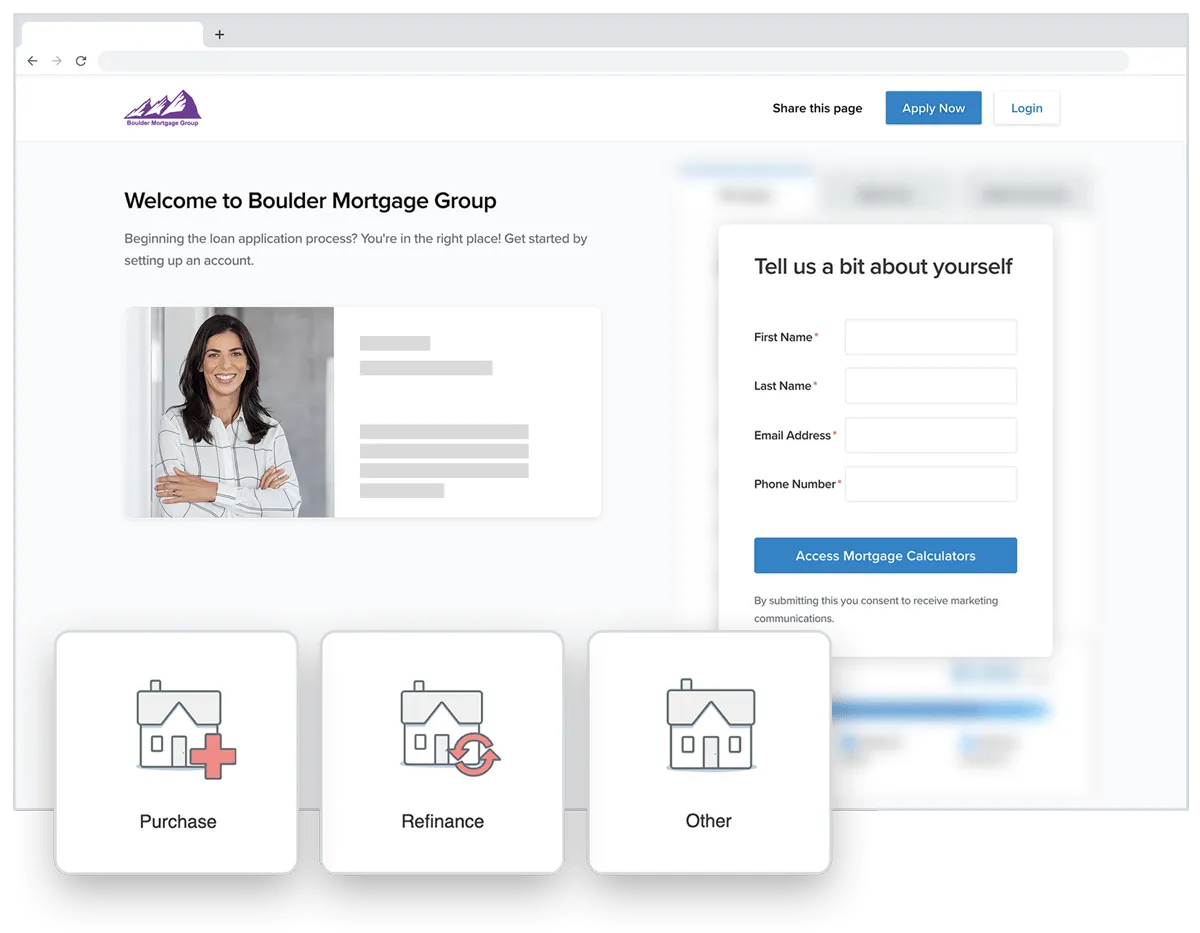

Efficiently manage the mortgage process with your own branded digital portal. Spend more time with your clients or your family instead of chaotic paperwork.

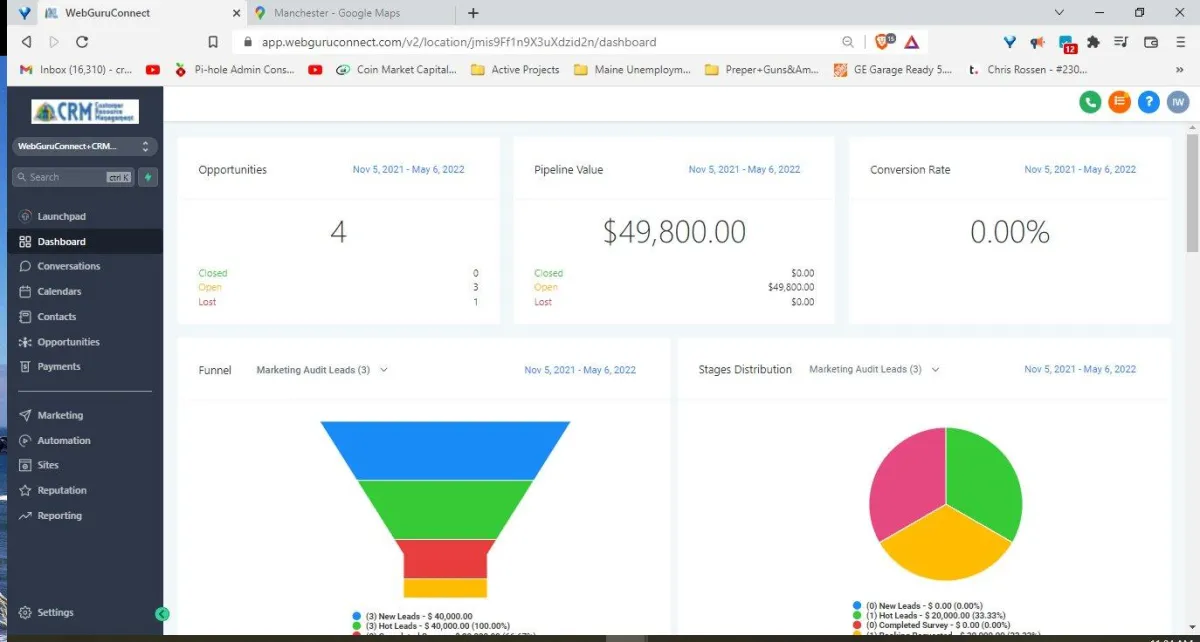

RELoanLink provides mortgage companies with a secure mortgage marketing system. Our system tracks inbound leads and integrates a point-of-sale (POS) portal that provides a web-based dashboard for your borrowers to interact with a dynamic 1003 loan application process.

Borrowers can easily complete a loan application, upload supporting documentation, eSign disclosures, and monitor the status of their loan — in a single, easy-to-use location.

Reclaim your day with fully-automated follow ups and loan updates.

Good communication is fundamental to a positive borrowing experience and keeps your referral partners sending business your way.

RELoanLink is packed with easily customizable and automated communication solutions so that your borrowers, referring agents, and other stakeholders get the info they want, when they want it.

Experience the difference of RELoanlink's platform and best-in-class digital 1003

Implement a smooth, polished digital 1003 to increase submission rates and data integrity.

RELoanLink's interview-style loan application provides a best-in-class application experience for borrowers, as well as a full suite of automation, customization, and branding options.

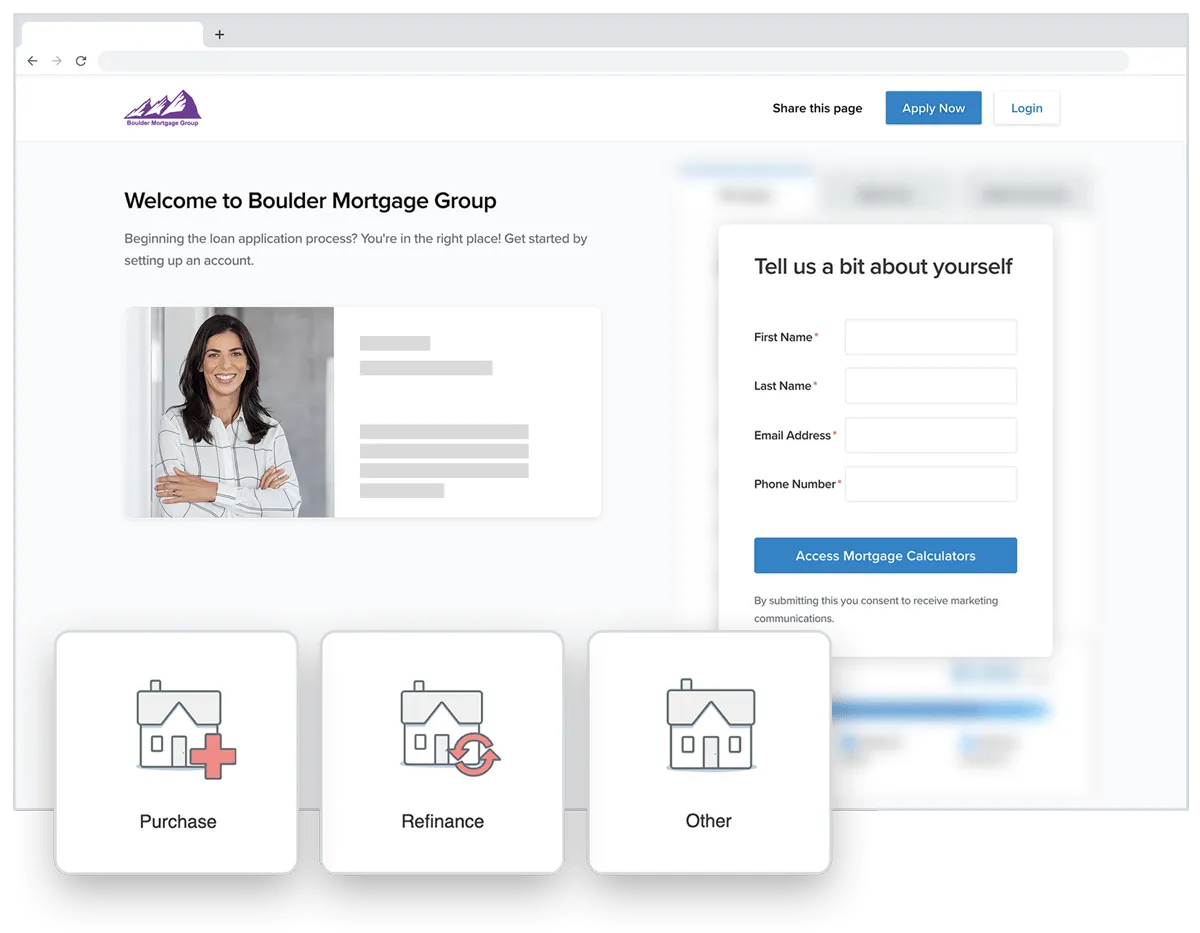

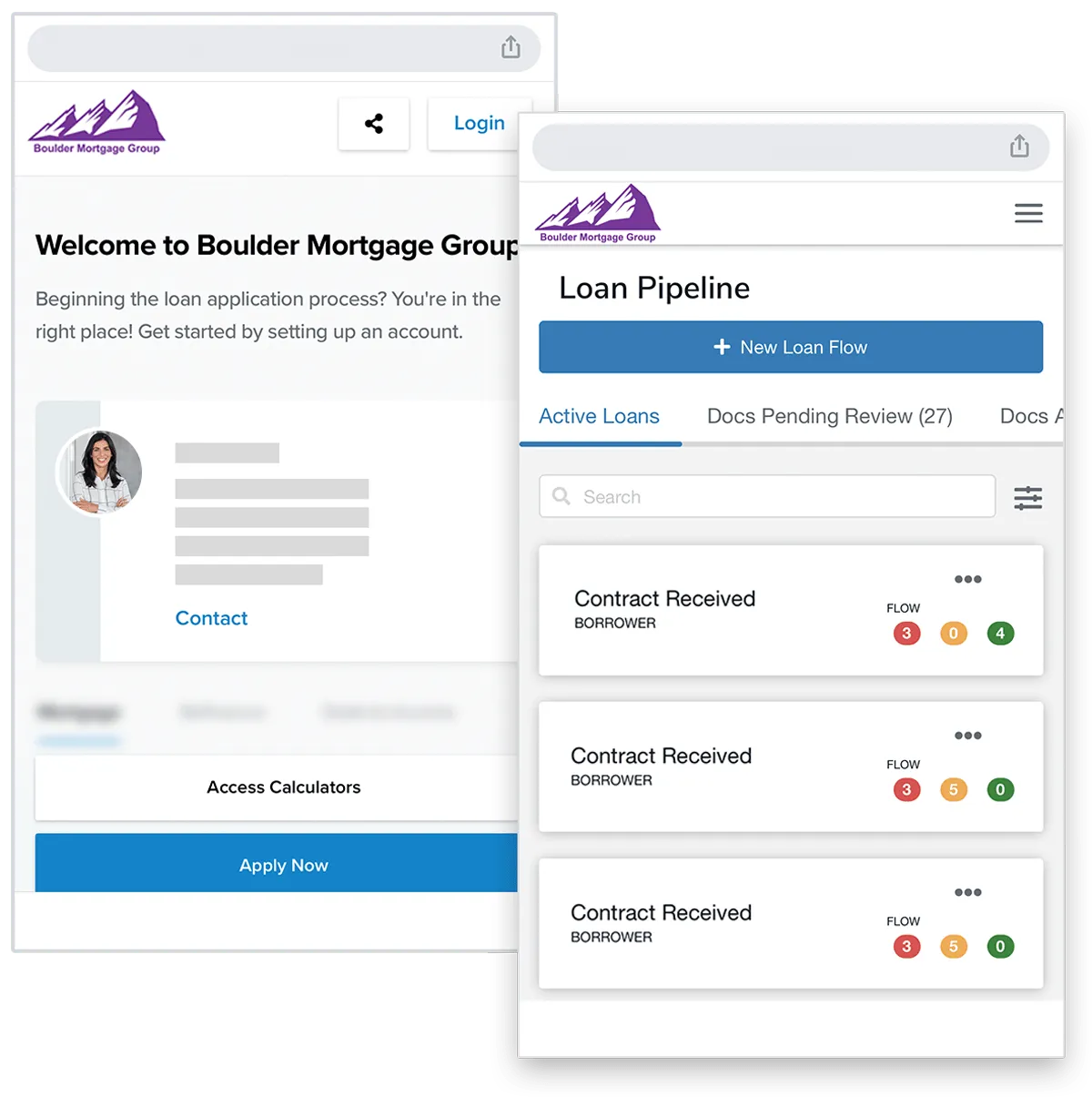

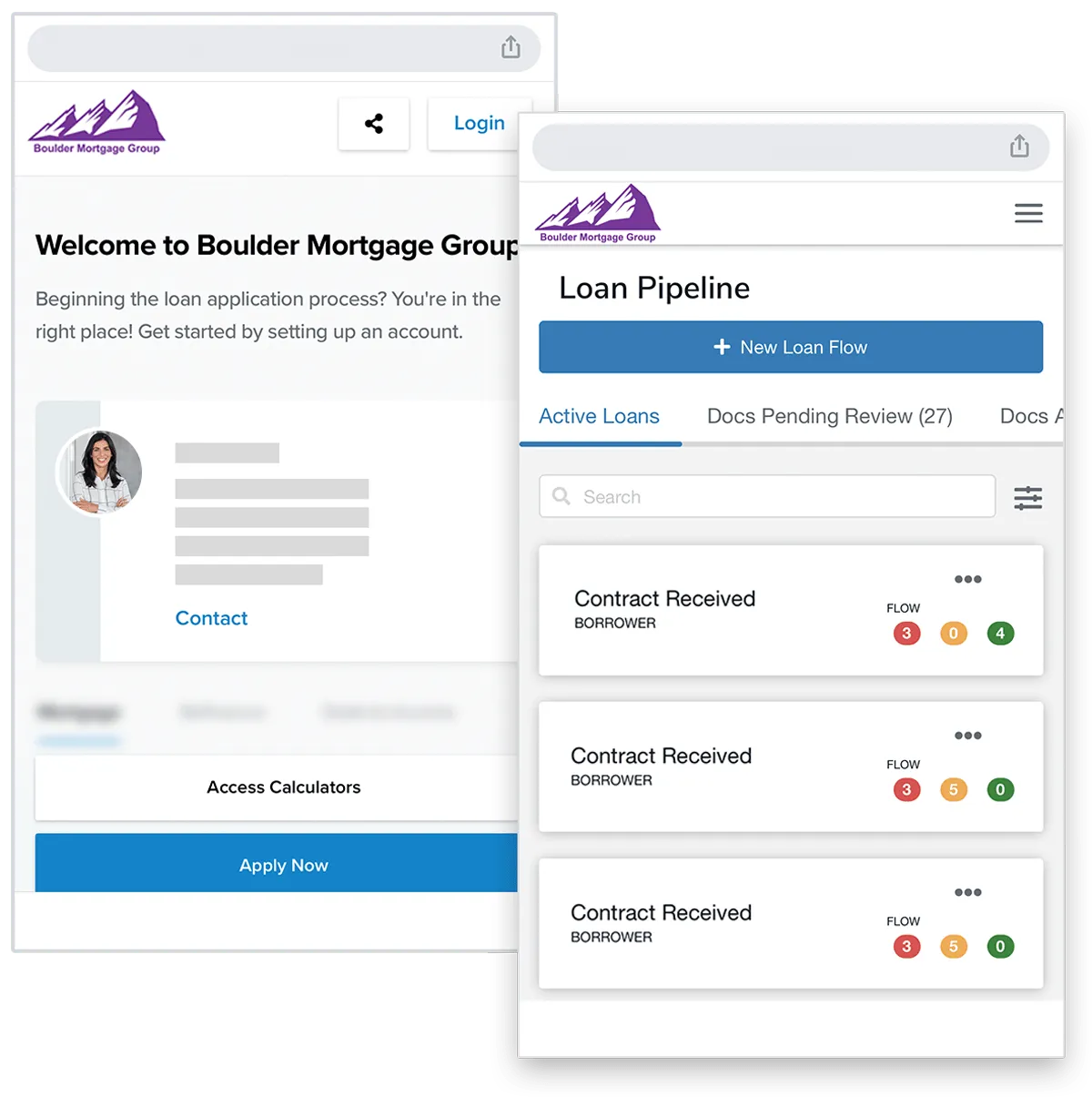

Make it easy for borrowers to do business on mobile!

Borrowers, Agents and Brokers increasingly prefer mobile methods of communication and engagement.

With a responsive design for mobile web browsers, native iOS and Android apps, and LO-branded progressive web apps, RELoanLink includes everything a loan originator could need to serve a mobile borrower.

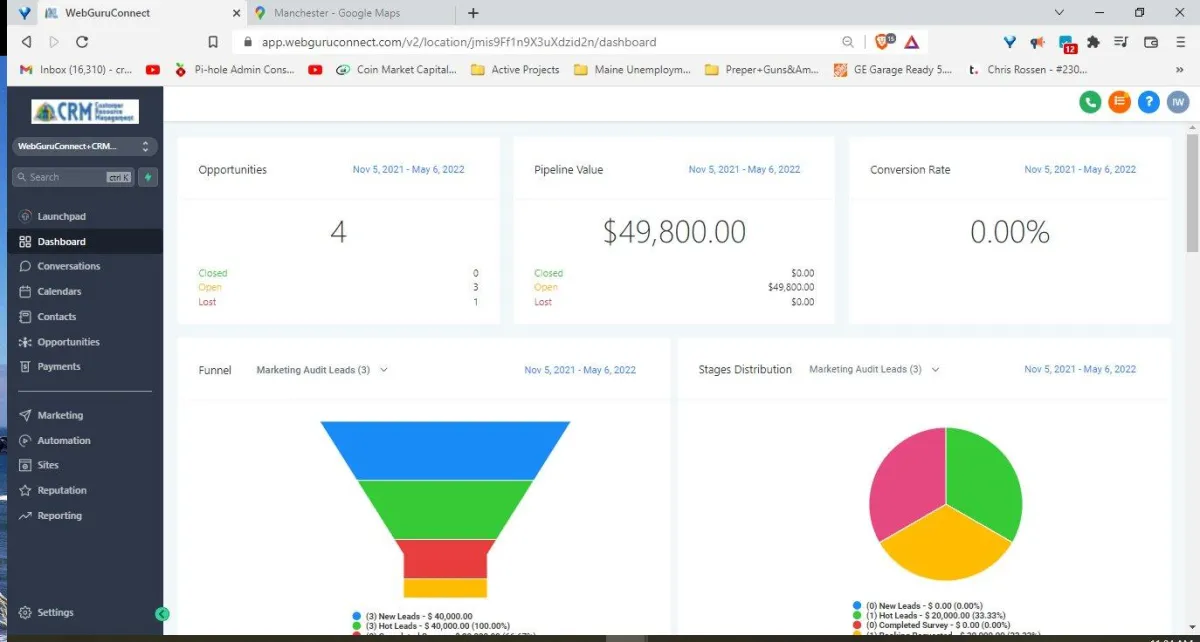

Harness the efficiency of integrated marketing and productivity solutions!

Increase operational efficiency and maintain loan file integrity by integrating the best-of-breed systems.

RELoanlink's suite of integrated solutions includes database reactivation and client follow-up. Our processing system follows asset, income, and employment verification providers, credit reporting agencies, LOS systems, eSignature, CRM, Cloud storage, and more.

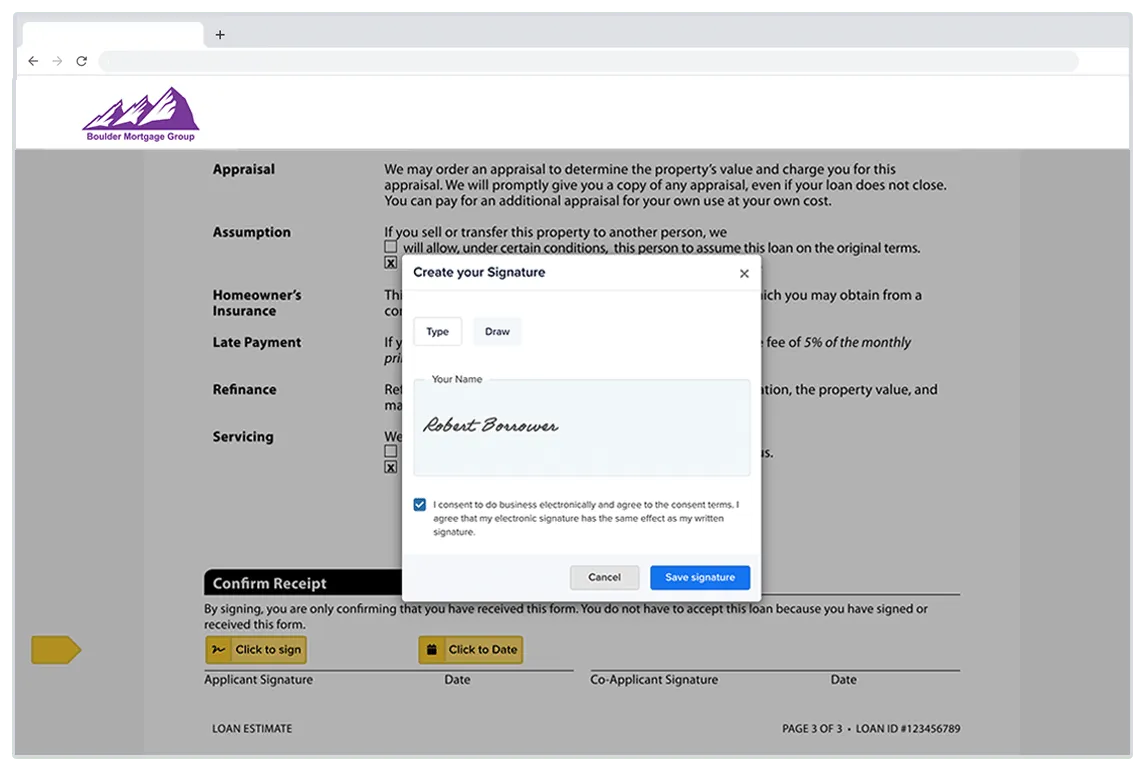

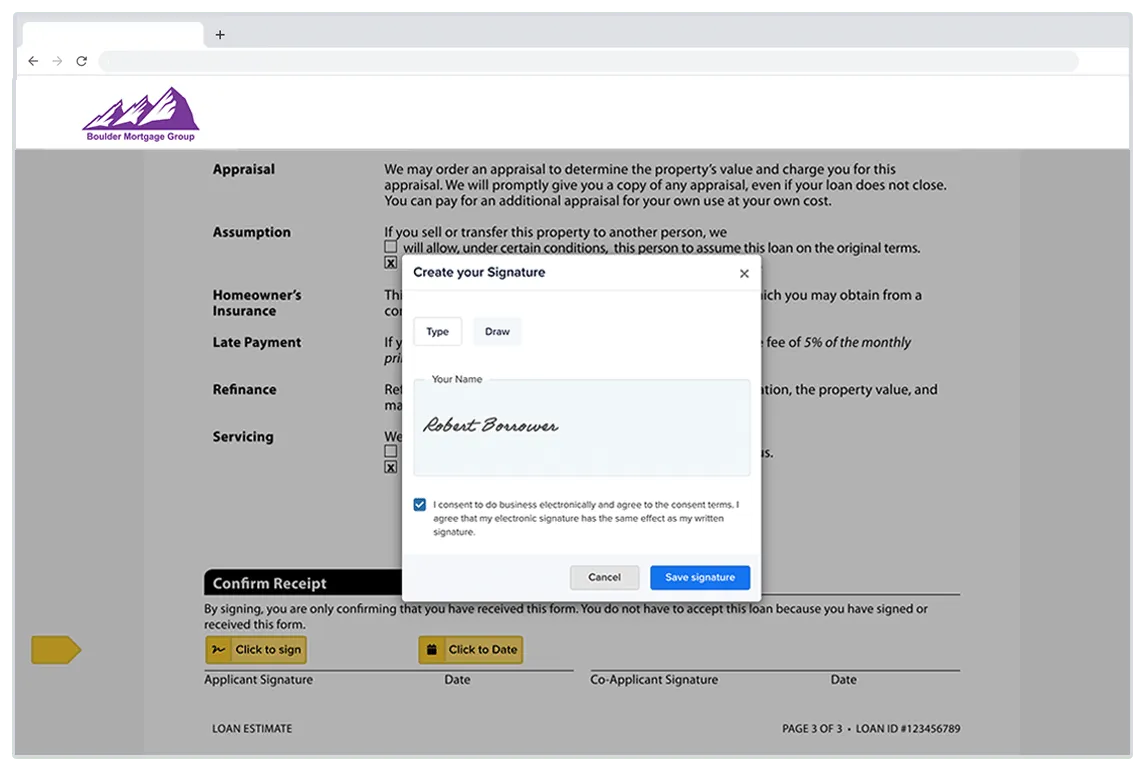

Implement a better disclosure process for your borrowers

RELoanLink's integrated Disclosure Desk solution works with Floify E-Sign or the DocuSign eSignature platform so lenders can deliver a smooth, single access end-to-end mortgage experience for borrowers.

Borrowers are able to receive, review, and sign disclosures within the same web-based portal. Your clients simply complete their loan applications and upload supporting documentation.

Customize, brand, and co-brand

Take advantage of a HUGE number of available customizations in order to customize your processes, and put your company brand front and center.

Add your company logo, color scheme, custom CSS and Javascript, email signature, custom data fields and layouts, co-branded partner landing pages, and much more.

Efficiently manage the mortgage process with a branded digital portal

RELoanLink's provides mortgage companies with a secure mortgage marketing system.

Our system tracks inbound leads and integrates a point-of-sale portal that provides a web-based dashboard for your borrowers to interact with their loan application process.

Reclaim your day with fully-automated loan updates

Good communication is fundamental to a positive borrowing experience, and keeps your referral partners sending business your way.

RELoanLink is packed with easily customizable and automated communication solutions so that your borrowers, referring agents, and other stakeholders get the info they want, when they want it.

Experience the difference of RELoanlink's best-in-class

digital 1003

Implement a smooth, polished digital 1003 to increase submission rates and data integrity.

RELoanLink's interview-style loan application provides a best-in-class application experience for borrowers, as well as a full suite of automation, customizations, and branding options.

Make it easy for borrowers to do business on mobile

Borrowers and agents are increasingly preferring mobile methods of communication and engagement.

With a responsive design for mobile web browsers, native iOS and Android apps, and LO-branded progressive web apps, RELoanLink includes everything a loan originator could need to serve a mobile borrower.

Harness the efficiency of integrated productivity solutions

Increase operational efficiency and maintain loan file integrity by integrating your best-of-breed systems.

RELoanlink's suite of integrated solutions includes asset, income, and employment verification providers, credit reporting agencies, LOS systems, eSignature, CRMs, cloud storage, and more.

Implement a better disclosure process for your borrowers

RELoanLink's integrated Disclosure Desk solution connects to an Enterprise's LOS and Floify E-Sign or the DocuSign eSignature platform so lenders can deliver a smooth, single access end-to-end mortgage experience for borrowers.

Borrowers are able to receive, review, and sign disclosures within the same web-based portal where they complete their loan application and upload supporting documentation.

Customize, brand, and co-brand

Take advantage of a HUGE number of available customizations to tailor Floify to your processes, and put your company brand front-and-center.

Add your company logo, color scheme, custom CSS and Javascript, email signature, custom data fields and layouts, co-branded partner landing pages, and much more.

Plain speaking Marketing advice.

From Marketing Pros that Specialize in Mortgage Lead Generation

Whatever your situation, we are here to help map out objectives and plans to Execute. We’ll use our extensive knowledge and experience to find you the best possible solutions.

What are your goals? Everyone is unique, let's talk about your personalized needs.

Plain speaking mortgage advice. From Mortgage Business

Whatever your situation, we'll listen to your problems (if any), objectives and plans. We’ll then use our extensive knowledge and experience to find you the best possible solution. Having unlimited access to mortgage lenders and life insurance companies means we’ll be able to make it as cost effective as possible!

What are your goals? Everyone is unique, request your personalized quote.

You Have a Question? We Are Here To Help!

310-773-3557

support1@reuplink.com

Contact us

Quick Links

About Us

Blog

Privacy Policy